It takes longer to process paper forms sent to. Amount paid or due and payable on each share.

Return Of Allotment Of Shares Sh01c Gov Uk

Before filing the Return of Allotment of Shares for your company you will need to prepare the following information.

. Amount if any unpaid on each share. What is return of allotment. Updated list of shareholders and their shareholdings.

If the company has period for the date of allotment what is the date used for the calculation of late lodgement. Filling out Return Of Allotment Of Shares - Bizfile - Bizfile Gov does not really have to be complicated any longer. It is to be done within 30 days of shares allotment by filing an e-form PAS 3.

From now on easily cope with it from home or at the office straight from your mobile or desktop computer. It is a statement that includes the details of the shareholders and the allocated shares which are subjected to submission to the Registrar with an accented form from the Directors of the company. For the completion of all of the above our fee starts from only 250VAT for a Share transfer in a Private Limited Company.

Add the allotment dates. In most cases the shares youre informing Companies House about will be allocated on the same day so theres usually no need to fill in the To Date line. For further information Please refer to our guidance at wwwcacgovng Description.

Due to a written or oral contract. Making changes to the RBO if necessary. Upload Edit Sign PDF Documents from any device.

Yes all Return of Allotment of Shares ROA occurring after 31 January 2017 must be lodged online MyCoID 2016. If company fails to make allotment of shares within 60 days then the company will be liable to refund such money to the subscribers within 15 days from expiry of such 60 days. Know all how the procedure and requirements.

While public companies are free to allot new shares anytime but they also have to fill the Return of Allotment of Shares transaction within 14 days of allotment. It is of utmost importance that a firm when allocating shares and securities must file a return of allotment in e-Form PAS-3 to the Registrar on the Ministry of Corporate Affairs MCA portal within thirty days along with the full list of the beneficiaries to whom such shares and bonds have been issued. Allotment of Shares under the companies act 2013 is basically the distribution of shares to existing shareholders or new shareholders.

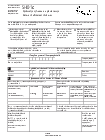

RETURN OF ALLOTMENT OF SHARES. Ad Single place to edit collaborate store search and audit PDF documents. RETURN OF ALLOTMENT OF SHARES What this form is for You may use this form for allotment of issued share capital and notice of increase of share capital What this form is NOT for You cannot use this form for transfer of shares.

Company shall make allotment of shares within 60 days of receipt of application money. If the company has period for the date of allotment the date of lodgement of the. Informing the CRO on the next annual return.

In making a return of allotment under section 54 of the Companies Act 1965 it is to be noted that - a where shares are allotted for consideration other than cash the return should be accompanied by the contract see section 54 3 and 4 or if there is no contract in writing by a statement made in accordance with Form 25. Return of Allotment of shares CAC 5 Pursuant to Section 154 CAC 5 of the Companies and Allied Matters Act 2020 RETURN OF ALLOTMENT OF SHARES What this form is for You may use this form for allotment of issued share capital and notice of increase of share capital What this form is NOT for You cannot use this form for transfer of shares. When it is required.

Amount paid if any or deemed to be paid on the allotment of each share. Issue of New Share Certificates. SH01 return of allotment of shares PDF 674 KB 10 pages Details This form can be used to give notice of shares allotted following incorporation.

We can have all the above prepared. Reasons for Allotment of Shares Shares can be allotted for cash or consideration other than cash due to the following reasons. Number of shares allotted.

Number of shares allotted for consideration other than cash. FORM 24 Companies Act 1965 Section 541 Company No. You must use ALL CAPITALS to fill in the form.

Class of shares that are being issued. Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates.

Before you fill in the SH01 be mindful of the From Date youre going to enter. Updating the register of members and other registers as required. Submit copy of contract in writing relating to the allotment including particulars of the valuation of the consideration.

RETURN OF ALLOTMENT OF SHARES Number of shares allotted payable in cash.

Form 24 Return Of Allotment Of Shares Pdf

Pas 3 Form Return Of Allotment Learn By Quickolearn By Quicko

0 Comments